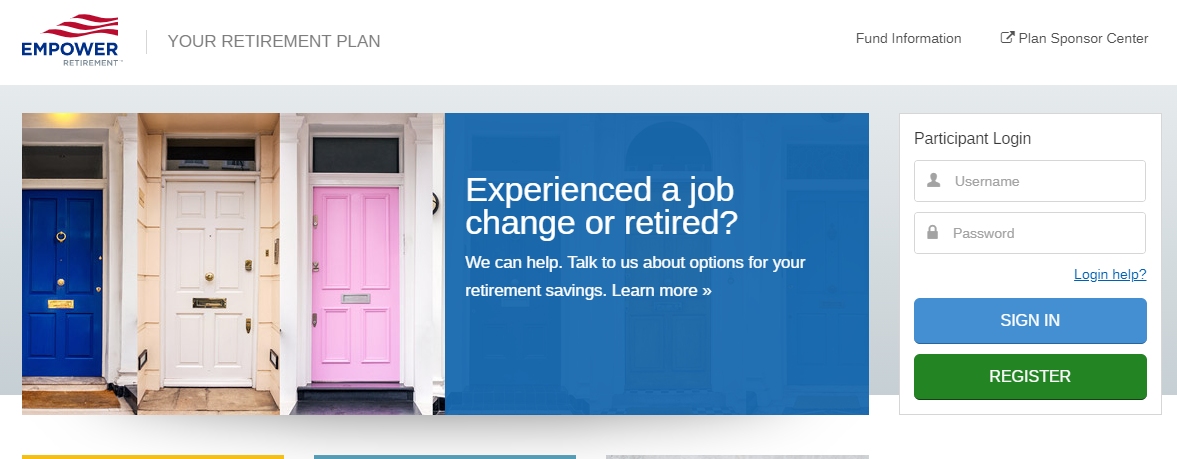

Empower Retirement Login:

- To login open the webpage www.empower-retirement.com

- Once the page appears at the center click on the ‘Log in’ button,or go to the participant.empower-retirement.com page.

- In the login dropdown provide an email or username, password. Now click on the ‘Sign in’ button.

Recover Empower Retirement Login Details:

- To retrieve the login initials open the page participant.empower-retirement.com

- After the page appears in the login homepage hit on ‘Log in help?’ button.

- In the homepage provide SSN, zip code, last name, date of birth, address click on ‘Continue’ button.

Register for Empower Retirement Account:

- For the sign up open the webpage participant.empower-retirement.com

- As the page appears in the login homepage click on ‘Register’ button.

- You have to enter SSN, zip code, last name, date of birth, address click on ‘Continue’ button.

Also Read : Access to Kia Motors Finance Account

Empower Retirement Account :

They’re the second-biggest retirement administrations supplier in the United States, serving more than 67,000 plans and 12 million members. They’re uniquely centered around retirement, with mastery across all arrangement types, organization sizes and market segments.

With the new expansion of Personal Capital, an advanced previously enrolled venture counselor, and abundance chief, they are ready to convey customized guidance, monetary wellbeing, and amazing, proficient evaluation monetary apparatuses to a large number of individuals.

Features of Empower Retirement:

- They are engaging individuals by making retirement arranging more customized, more open, and more obvious.

- They are enabling managers by surpassing their assumptions with arrangements that make their work simpler paying little heed to the size or kind of their retirement plans.

- They are engaging accomplices by rejuvenating a common responsibility and association that permits their customers to succeed.

Retirement Planning Tips:

- Screen Your Interests in Pre-Retirement: Money required 5-10 years into retirement is generally powerless, so abstain from overspending. On the off chance that that cash is lost, it is more diligently to recuperate over the long haul. Search for speculations with unsurprising pay sources, yet recollect the more unsurprising the pay, the lower the return.

- Talk with Your Life Partner or Huge Other About Retirement Spending: open up to your mate or critical other about the amount you figure you ought to, and will, spend in retirement so that you’re both in total agreement. Similarly, as couples examine purchasing another vehicle or a house while working.

- Zero in On Actual Wellbeing: Given the significant expenses of medical care, zeroing in on actual wellness today is vital to remaining monetarily fit in retirement. Medical services costs are regularly neglected by retired folks, notwithstanding the way that it’s continually in the information is as yet going wild.

- Make A Financial Plan and Follow It: The most ideal approach to design a financial plan is to realize the amount you can spend. Yet, oh well, the vast majority try not to compute the amount they can securely spend in retirement. In the event that you need assistance beginning, meet with speculation proficient.

- Get A Wise Speculation Proficient: You go to the specialist to help you stay sound, so having a venture proficient you work with consistently is a shrewd method to anticipate financial wellbeing in retirement. Ask companions for suggestions on who they use, since references are regularly the most ideal approach to find a wise venture proficient.

- Watch Travel Costs in Retirement: Travel is less expensive and simpler when you’re portable, so go on large outings when you are more youthful. Try not to save the entirety of your excursions for retirement as this will be all the more exorbitant. Additionally, don’t take excessively costly get-away.

- Work Longer: One of the most ideal approaches to guarantee you have adequate cash well into retirement is to work a couple of extra years, past what you initially had arranged. It may not be what you need to do, however it will add more pad to your savings over the long haul.

Empower Retirement Customer Help:

For more help options call on 855-756-4738.

Reference Link:

participant.empower-retirement.com