jetbluemastercard.com/activate – How to Activate and Apply your JetBlue MasterCard Online

Finance

The JetBlue World Mastercard (JetBlue Card) is issued by Barclays Bank Delaware (Barclays) pursuant to a license from Mastercard International Incorporated. They are known as transatlantic consumers and wholesale banks with a global reach. They may not have branches but have deep roots. They are part of a network of 85,000 people strong who move, lend, invest and protect money for customers and clients across 40 countries.

They collaborate with over 25 top companies to deliver an array of consumer and small business credit card programs to fit any lifestyle in the US market. your personal finances are always handy—from credit cards to savings, CDs, and loans with this digital banking platform. They also offer simple tools that make it easy to plan, and there’s always a real person ready to help you when you need it.

Jet Blue Master card features and benefits:

- On eligible inflight purchases including cocktails and food, you will get 50% savings.

- You don’t need to pay any foreign transaction fees.

- You will get the benefits of chip technology.

- You will not responsible for unauthorized charges you report to them with the 0% fraud liability protection.

- On balance transfers made within 45 days of account opening you will get 0% APR for 12 months.

- A variable APR will apply 15.99%, 19.99%, 24.99% based on your creditworthiness after the first 12 months.

- With this master card you will get 3x points on Jet blue purchases, 2x points on all restaurants and grocery purchases and 1x points on all other purchases.

- Points awarded into your TrueBlue account will not expire.

- You can Earn and share TrueBlue points together with Points Pooling.

- You can redeem any seat any time on a JetBlue-operated flight.

- You will get no blackout dates on JetBlue-operated flights.

Types of Jet Blue Master card:

Barclays is known as a multinational investment bank and financial services company. This company ensures that people like you shouldn’t suffer when it comes to financing. They will offer four (4) types of JetBlue Master Cards so that you can get a credit card during your financial deficit.

- JetBlue Plus World Elite MasterCard:

In the first three months of receiving the card, you will get 40,000 points after spending $1,000. You will get an annual fee of $99.

- JetBlue Rewards World Elite MasterCard:

Through this card you can get a 50% discount on in-flight purchases and rewards including 2x dining and groceries, 4x JetBlue, 1x everywhere else, etc. you will get the annual fee of $40.

- JetBlue Business MasterCard:

If you want to make your grocery shopping interesting then you can activate your JetBlue Business MasterCard. You will get 50,000 points if you spend $1,000 in the stipulated period like JetBlue Plus Card. You will also get 10,000 extra points by adding an employee card and buying products within the first three months.

- JetBlue World MasterCard:

Through this card, you will get several benefits such as a 50% discount on in-flight purchases, no annual fee, 15,000 points on purchases in the first 3 months.

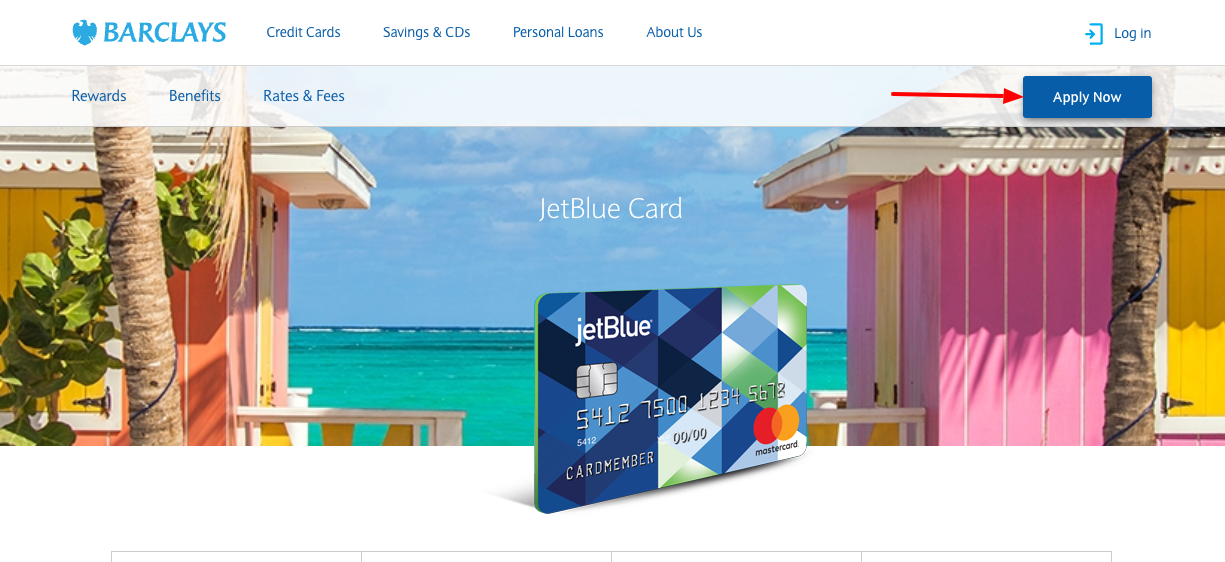

Jet Blue MasterCard Apply:

If you want to apply for Jet Blue Master Card then follow these simple steps to apply online.

- First, you have to visit the Jet blue official website cards.barclaycardus.com/banking/cards/jetblue-card

- Then type your last name and personal id code in the given space.

- Then click on Apply now button.

- Then you will be redirected to a new website where you have to fill up a form.

- Provide accurate information about your employment and financial status.

- Finally, you have to review the fees associated with the credit card of your choice.

- Anyone can submit this application but the decision will depend on the applicant’s financial portfolio.

Eligibility for Applying Jet Blue Master card:

Applicants need to satisfy the following requirements by the bank to become successful Jet Blue master cardholders.

- Applicants must have a jet Blue online account.

- You must have a phone number.

- Applicants must be over 18 years of age to use the Jet Blue app.

- You must have good credit (i.e. a score of at least 700) to get the JetBlue Credit Card.

- You must not be bankrupt or had an Individual Voluntary Arrangement or Debt Relief Order in the last six years.

- You must not have any outstanding County Court Judgement (CCJ’s) in the last six years.

- You must have proof of your current address.

- You need to have a good record of paying bills on time.

Fees and Charges:

- Annual fee: 0

- Balance transfer: Either $5 or 3% of the amount of each transfer, whichever is greater.

- Foreign transaction: 0% of each transaction in U.S. dollars.

- Cash advance: Either $10 or 5% of the amount of each cash advance, whichever is greater.

- Late payment: Up to $39 which varies depending on the state

- Returned payment: Up to $39 varies depending on the state

- Minimum interest charge: The charge will be no less than $0.50 in case you are charged.

- APR for Cash Advances: 25.24%

- APR for Balance Transfers: 0% introductory APR for the first twelve billing cycles following each balance transfer within 45 days of account opening. your APR will be 15.99%, 19.99%, or 24.99% based on your creditworthiness after that.

- Grace period: 23 days

Jet Blue MasterCard Activation:

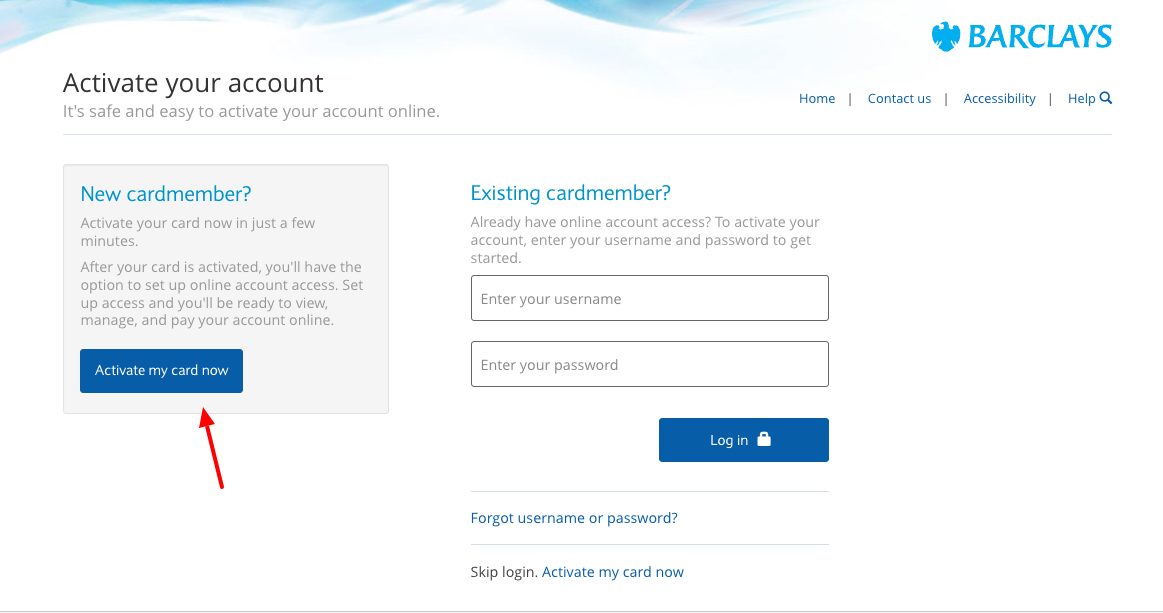

- Online method

You will need to have an online account first if you choose to activate your card online. But if you don’t have an online account then first sign up with details required i.e., bank account details, social security number, and date of birth. Once you get online access, follow these steps to activate your card.

- First, you have to switch on your computer or laptop.

- Then launch your browser.

- Then you will need to type the activation link in the URL – jetbluemastercard.com/activate

- You have to click on the “Activate my card now” option if you are a new cardholder.

- Then another page will appear.

- There the system will verify your details to “ensure that you are the only person with access to the account”.

- There you have to provide the last 4 digits of your SSN, your birth details – MM/DD/YYYY and your “Account Number” in the given place.

- Then you have to enter the “Security code” provided on the back of the card, a 3-digit code in case of Master Card or Visa Card. But in case of AMEX card the 4 digit will be on the front of your card.

- Then you will need to specify your “Occupation” from the drop-down menu (Engineer/Scientist, Doctor/ Dentist/ Pharmacist, Accountant, Education, Clergy/ Pastor, Cashier/ Clerk/ Server, etc.)

- After that you must clear on whether you are a US citizen.

- For that you have to Click “Yes” or “No” to the question “Are you a United States Citizen?”.

- Then press on the continue button.

- Finally, you have to follow the on-screen guidelines to complete the card activation process.

Through phone call:

If you don’t have any Wi-Fi and still want to activate your card then you can follow these steps to activate your card.

- First, you have to switch on your Phone.

- Then dial (877) 408-8866.

- You have to follow the instructions to easily activate your Barclays credit card.

- You can easily get the number from the “Contact Us” page if you have knowledge of the internet.

- For that, you just need to visit the homepage of Barclays and select the “Contact Us” option available there.

Through Jet Blue mobile app:

You have to check these steps to activate the card using your Jet Blue Card.

- First, you have to install the Jet Blue app on your smartphone.

- You have to log in.

- Then press the option “Jet Blue Master card”.

- Your card has been activated.

- Now you can manage your account as well.

Benefits of Online Banking:

You can have some great advantages if you have an online account with the Jet Blue Master card. You must check out these features before creating a Jet Blue online account.

- With online banking, you can check balances, transfer money and pay bills.

- You will be able to view and download statements.

- It will be easy to manage Direct Debits and standing orders.

- You can view your debit card PIN.

- You can easily report a lost or stolen card.

Jet Blue Master card Login:

- First, you have to Launch your web browser (Chrome or Safari) on the laptop or computer.

- Then you will need to navigate to jetbluemastercard.com/activate

- There you have to find the option that says “Existing Customer?”.

- Provide your last name, and either your Online Banking membership number, your card number or your sort code and account number to the mandatory fields given.

- Click on the ‘Next step’ option.

- Then press the ‘Log in with passcode’ option there.

- You have to be sure that the ‘Login details’ option is selected.

- There you have to provide your passcode and the requested characters of your memorable word.

- Then tap on the ‘Continue’ when you’re ready.

- For an extra security check, you may be asked for your card details.

- You have to type the one-time security code on your computer once you get it.

- Finally, tap on ‘Login to Online Banking’ to continue.

Also Read: How to Access My Prepaid Center Account

Jet Blue Master card password recovery:

If you’ve forgotten any of your login details then don’t need to worry about. You need to follow these simple steps for resetting your user’s name or password.

- First you have to visit the JetBlue MasterCard activation page.

- You have to find for the “Forgot Username or Password?” link.

- You have to tap on it after finding the link.

- A new page will appear.

- Verify your account on that page.

- You have to provide the last 4 digits of your SSN, DOB in the DD/ MM/ YYY format, and Account Number there in the given place.

- Finally, you have to tap on the “Continue” button.

- You can retrieve your username or password easily.

Jet Blue master card bill payment:

You can use the Barclays website or mobile app for making a Barclays credit card payment online. You can also pay by phone, through the Barclays mobile app, by mail, or at a branch. There you can also review your statements and account balance, can set up payment notifications, and manage your card. There you can also choose how much to pay when to pay it, and where the payment is coming from.

- Online bill payment:

You’ll first need to set up online access and then log in through the site or app and set up a payment account like your savings or checking account.

- First you have to Log in to your Jet Blue Master card account online.

- You can also launch the Jet Blue App on your mobile device.

- There you will have to choose “Payments” from the main navigation menu.

- There you have to select “Make a Payment.” Option.

- Then you will need to link an eligible checking or savings account from which to make payments.

- You have to choose the “Add a bank account” option there and provide your account details.

- Then select a payment amount from the available options there and pay the minimum amount due, the full statement balance, the current statement balance, or enter another amount of your choosing.

- You have to select a payment date, or simply select “pay now” to send your payment on the earliest date available.

- Then choose a payment account from your available bank accounts.

- After that tap on “Review and Verify” to confirm the details of your payment.

- Finally tap on the “Pay now” to make your payment.

- You can set a payment date, amount, and payment account to be used for each automatic payment through selecting a Repeat payment option.

Payment through mail:

If you want to use a check or money order but not cash, you can mail your payment in to Jet Blue’s. You have to Put your card number on the memo or note field of your money order or check so the company applies it to the right account. You have to be sure to send it early enough that it will arrive by the due date.

Mail it to JetBlue Card Services, P.O. Box 60517, City of Industry, CA 91716-0517.

- Call In payment:

You can make a Jet Blue Master card payment by phone using a checking or savings account which requires calling (877) 408-8866 to reach the cardholders’ services.

The system will prompt you to give the last four digits of the card you need to pay during call and will ask for the last four numbers of your Social Security number to check that you’re the right card member. Then you have to confirm the information, you’ll access a voice automated system that will tell you information about your account such as your payment due date and minimum payment.

Then tell the automated system you want to make a payment and follow the prompts to give a payment amount and date and provide the information for the account you want to use to make a payment. At the end of the call, you will get a payment confirmation number.

Getting Started with your Jet Blue Master Card:

For starting the use of your Jet Blue master card, you have to follow certain steps which are mentioned below. Check out these steps before activating your card.

- First you have to activate your jet Blue master card.

- Then visit com/activate for set up online access. Or you have to call (877) 408-8866.

- You have to update any bill payment services for paying your credit card bill with your new account information.

- You have to set up automatic bill payments for your account. Update online merchant accounts for storing your credit Card informations for expedited check outs as well as any digital wallets.

- You have to manage your account online, set up repeat payments, enroll in paperless statements for viewing your cards feature and benefits.

Lock your Jet Blue Master card:

You can instantly lock and unlock your Jet Blue Master card if lost or misplaced to prevent it from being used for purchases from its mobile app. You will also be able to set transaction limits and even block certain purchases for yourself or authorized users with its Control your card feature. Jet Blue app will send you notifications through which you can monitor spending and catching fraudulent purchases as soon as they happen. You just have to follow these few simple steps.

- Open your Jet Blue mobile app first.

- Log in with your credentials.

- You have to select the card you want to freeze.

- Then tap on the “Control Your Card” option.

- After that press the “Lock or Unlock this card” option there.

- You have to change the settings so that your card is in the locked position.

- This will stop new purchases with the card, including cash advances.

- But this will allow merchant-indicated recurring bill payments, returns, credits, dispute adjustments, payments, account fees, interest, and rewards redemptions.

- You have to navigate back to the Secure Hold page and unlock your card to use your card again.

Customer Support:

For general concerns, there is a customer support which will help you 24 hours a day, 7 days a week.

You can contact the Customer Service phone number on the back of your credit card.

©2020 Barclays Bank Delaware, Member FDIC.

JBM_JB03_072020

BAR-7845-3

Reference:

jetbluemastercard.com/activate

cards.barclaycardus.com/banking/cards/jetblue-card